Online trading is growing quickly, and there are so many platforms that are available for retail as well as institutional investors.

But there are a lot of factors to consider before you decide to invest through a platform or an app, such as regulation, trading instruments offered, fees, ease of use, investor protection etc.

By reviewing and comparing different trading platforms, we have made a list of the best trading platforms and what they have to offer to the Nigerian community.

This article will help you choose the best trading platform based on your trading requirements.

What is a Trading Platform?

A trading platform is a software that brokers offer to their clients for trading different financial instruments such as stocks/equities, indices, cryptocurrencies, commodities, currencies, gold etc.

Often the traders use charting tools, financial news, indicators before deciding on what order to place. The platform will offer you these features & ability to place orders in the market.

There are two types of trading platforms:

Third party commercial platforms: These platforms are built by 3rd party developers & offered by brokers instead of their own platform. The developer of the platform charge fees from the brokers for using their platform. Imagine it being like Shopify for trading.

Examples include Metatrader, Tradingview etc. that are popular among day traders and retail investors, so many brokers offer these platforms.

Proprietary platforms: These are platforms are the ones that are designed & developed by the brokers themselves. Large brokerages as well as retail brokerages offer these platforms to their customers.

List of Best Trading Platforms

Every broker’s platform has their own features, fees, mobile app, financial assets, that will be different from its competitors.

Traders generally have to pay a fee for using such platforms for trading. The exact fees however differ from broker to broker.

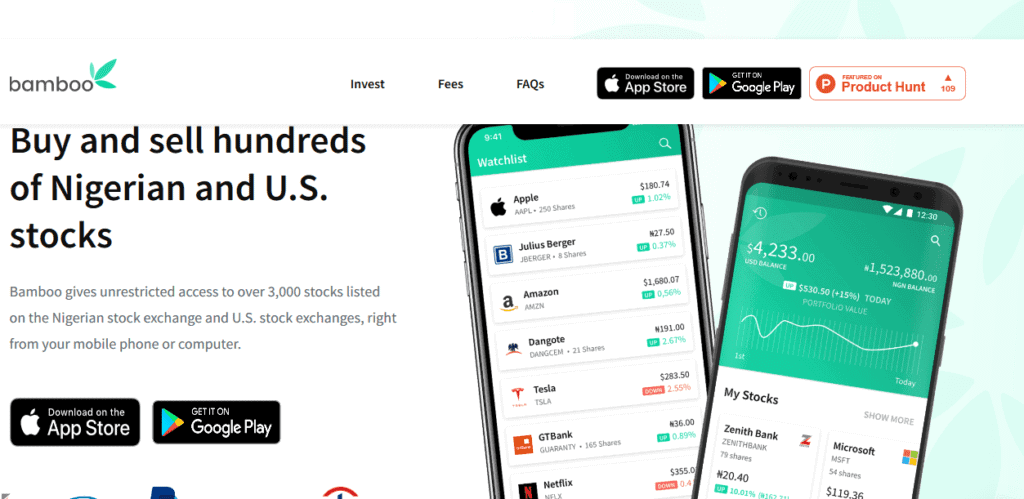

1. Bamboo App

Bamboo is an investment platform that allows traders & retail investors from Nigeria to investment in stocks listed at the US Stock Exchange and the Nigerian Stock exchange (NSE).

You can only trade in stocks at the Bamboo Investment app. It does not offer option to trade other instruments on its platform. Bamboo allows users to buy/sell over 3,000 stocks listed with US Stock Exchange and Nigerian Stock Exchange.

Bamboo charges 1.5% commission to trade stocks listed on the US Stock Exchange. Apart from commission fees, Bamboo also charges withdrawal fees. If you withdraw to your Naira account then you will be charged ₦45 for each withdrawal whereas you will be charged $45 if you withdraw to your USD bank account.

There is also a 30% withholding tax that is taken by the US government for trading in US stocks.

If you deposit with Naira account you can withdraw only to your Naira account and if you deposited via a USD bank account, you can withdraw only through that account.

There are charges such as the 0.3% fee that the SEC of Nigeria charges whenever a stock is bought. The NSE on the other hand charges 0.3% fee for selling a stock.

Central Securities Clearing System (CSCS) charges a fee of 0.378% when you sell a stock is 0.378% and a of 0.063% when you buy a stock.

The Nigerian property laws state that it will charge a fee of 0.075% whenever you buy or sell a stock on the Nigerian stock exchange.

Regardless of which investment platform you choose, you will need to pay these charges as per the SEC, NSE, CSCS regulations.

Features:

- Bamboo offers features such as Bank level security that offers two factor authentication services to its users as we as the excellent data encryption techniques that help store your financial information safely.

- Bamboo is protected by NG & US SEC which insures each user’s account up to $500,000.

Over 1,000 users have given it an average rating of over 3.8 on Play store, with over 100,000 installs.

2. Wealth.ng

Wealth.ng is an investment management platform that allows investors to invest in asset classes ranging from agriculture to real estate. It also offers stocks of many blue-chip companies that have good growth rates that increases value over a period of time.

Wealth.ng offers users the options to trade stocks, or invest in real estate, treasury bills and mutual funds.

Currently the trading platform is free and does not charge users any fee. But you will need to pay these charges as per the SEC, NSE, CSCS regulations.

Features:

- Wealth. ng has a group of wealth management experts who serve as a good guide to help you make the best investment possible.

- They also offer a Personal Wealth Advisor who helps in curating information and offer timely advise.

Their app has over 50,000 installs on Play Store.

3. Hotforex:

Hotforex is an international Forex broker that offers platform to trade forex & CFDs on different assets around the world.

Hotforex is regulated with FSCA in South Africa & is rated as one of the best forex trading apps in Africa & Nigeria as per expert reviews. Registered users of Hotforex can trade bonds, stocks, currency pairs, metals, ETF’s, cryptocurrencies etc.

Hotforex has very low fees for forex trading. They charge 1.2 pips fees with Micro Account and Premium Account & 0.1 pips with the Zero account.

Apart from this Hotforex does not charge any withdrawal or deposit fee. While the Micro and Premium account don’t have any extra commission, the users of zero account are charged a fee of $3 per Lot traded for majors and $4 per lot traded for minors.

Features:

- You can start with as little as $5 for forex trading

- It offers Negative balance protection

- Low fees for Forex Trading.

4. Chaka

Chaka calls themselves as the ‘Investment passport’ is an investment platform that allows to invest and trade stocks locally and globally.

Chaka allows you to invest in nearly 4000 blue-chip companies throughout the world. Chaka also has a calculator on its platform that allows you to calculate your trading costs before doing a trade.

Chaka charges 1% or $2 broker commissions for trading global stocks. Chaka charges N100 or 0.5% for very local trade conducted on its platform. Other fees include the fees that the SEC, NSE and CSCS charges for every trade.

Features:

- You can invest as low as $10 with Chaka to buy foreign stocks & you can buy fractional stocks. As low as N1000 for Nigerian stocks.

- It allows you to gift stocks to other users on Chaka

- It uses high-grade AES encryption software to protect customer information

It has over 100,000 installs on play store.

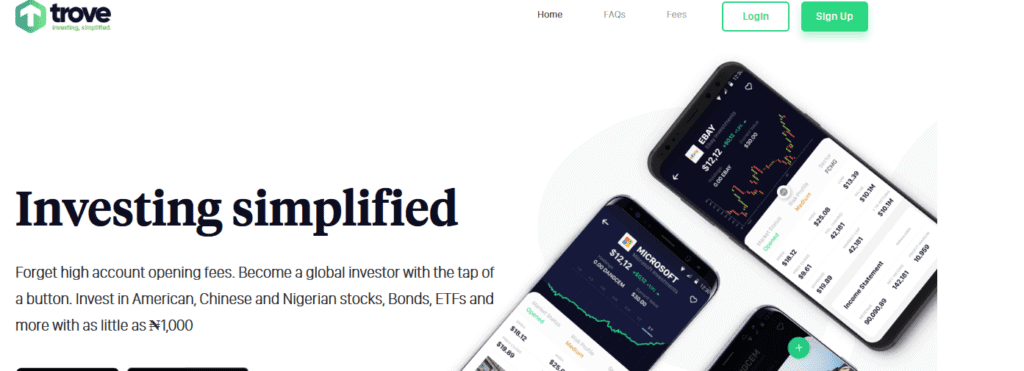

5. Trove:

Trove is an international investment platform that allows you to invest and trade international and local stocks on its platform.

Trove allows users to trade in wide variety of assets such as stocks from companies in US, China & Nigeria, Exchange-Traded Funds (ETFs), American Depository Receipts (ADRs) and Mutual Funds in Nigeria.

There are two ways of depositing funds into Trove, its either through a Naira wallet or a Dollar wallet. Trove charges 1% of Transaction Amount for buying and selling Foreign stocks. The trading fees as regulated by the SEC, NSE, CSCS will apply to all stocks that are bought or sold on the NSE.

Trove also charges brokerage fee at 1.35% and platform Fees 0.5% for trading local Nigerian stocks. Withdrawals are free regardless of which wallet you use. If you are using a debit/ credit card to fund your account then you will be charged 1.5% + ₦100 for transactions over ₦2,500.

Features:

- The minimum investment to trade on Trove is just ₦1000.

- All user data is encrypted with 256-bit encryption

- Investor protection up to $500,000 for US Traded stocks.

6. ForexTime

ForexTime (FXTM) is another forex trading platform. It’s regulated by CySEC, FSCA, IFSC and FCA.

FXTM allows users to trade forex currency pairs, Spot Metals, Share CFD’s, Commodities and Cryptocurrencies

FXTM charges a fee of 1.9 pips for major currency pairs like EUR/USD with their Standard account & 2.4 pips with their Micro Account. But apart from this, they have an account called the ECN account which has spread as low as 0.1pips.

FXTM does charge any deposit fee but it does charge a withdrawal fee of 1.5% of the total amount, if the withdrawal is made to a local account.

Features:

- FXTM offers a demo account which helps new investors learn from trading on live market with virtual money.

- It provides users with loyalty cashback if users trade with them for a long time

- They offer educational seminars and webinars to train new investors

7. Avatrade

Avatrade is also a forex broker that offers their services in many countries. Avatrade offers a platform where users can trade currency pairs, stocks, commodities, cryptocurrencies and indices.

Avatrade charges a fee of 0.9 pips for trading forex pair such as EUR/USD. There is also a swap fee which is charged for holding positions overnight. Avatrade does not charge any deposit or withdrawal fee.

Features:

- Avaprotect for investor protection.

- AvaTrade offers its users access to other platforms for copy and social trading with AvaSocial, ZuluTrade etc.